All logos and trademarks in this site are the property of their respective owners. The road tax on electric motorcycles in Malaysia is fixed at RM 2 for vehicles having an output rating of 75 kW.

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

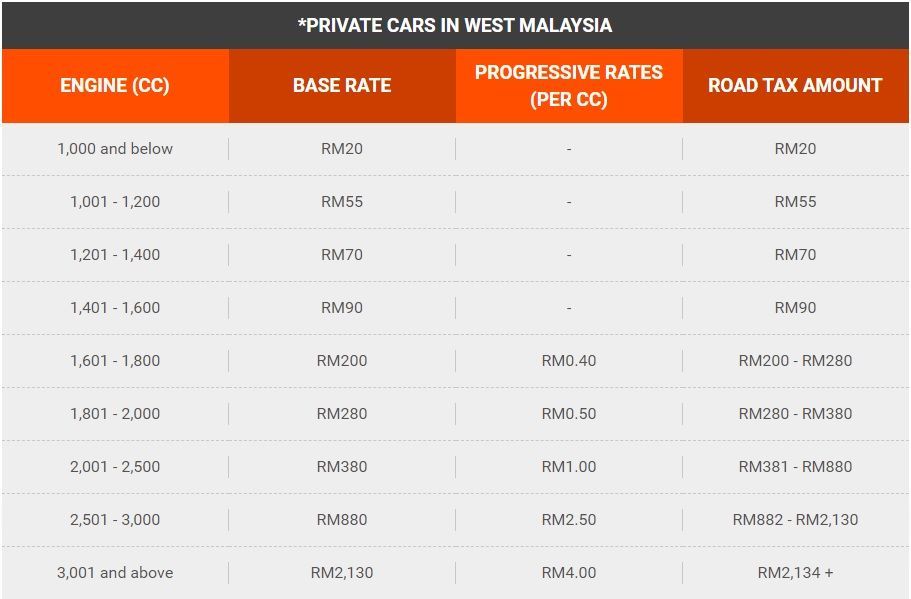

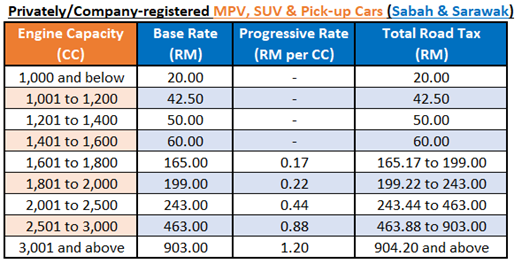

As you can see a car with a 16 litre 1600 cc engine or below gets charged a fixed flat rate from RM2000 to RM9000 only.

. The larger a vehicles engine the more road tax is payable. This applies to both petrol and diesel engines. Youll find prices specifications warranty details high-resolution photos expert and user reviews and so much more packaged in a user-friendly intuitive layout that is easy.

Motor Vehicle License LKM rates calculation guidelines for Electric Vehicles in in the link. JPJ ONLINE ROAD TAX RENEWAL. Road Tax for Private Car and Motorcycle JPJ Road Tax for Electric Vehicle.

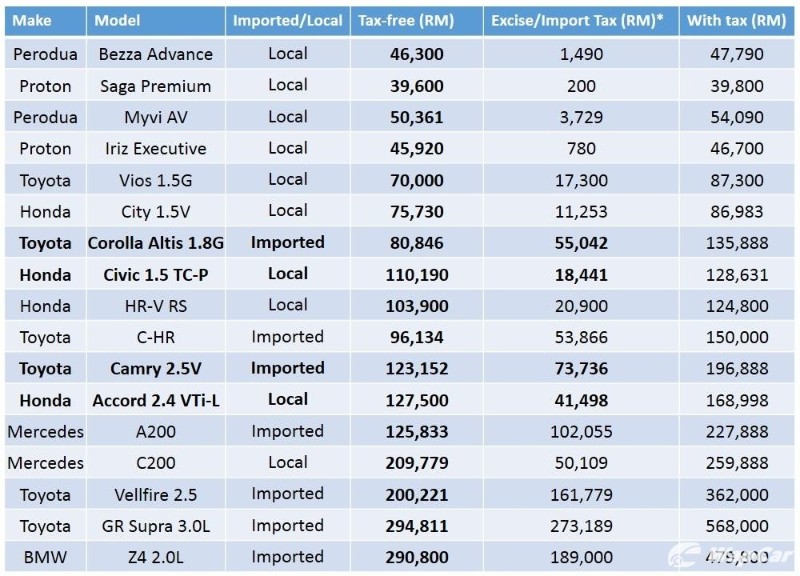

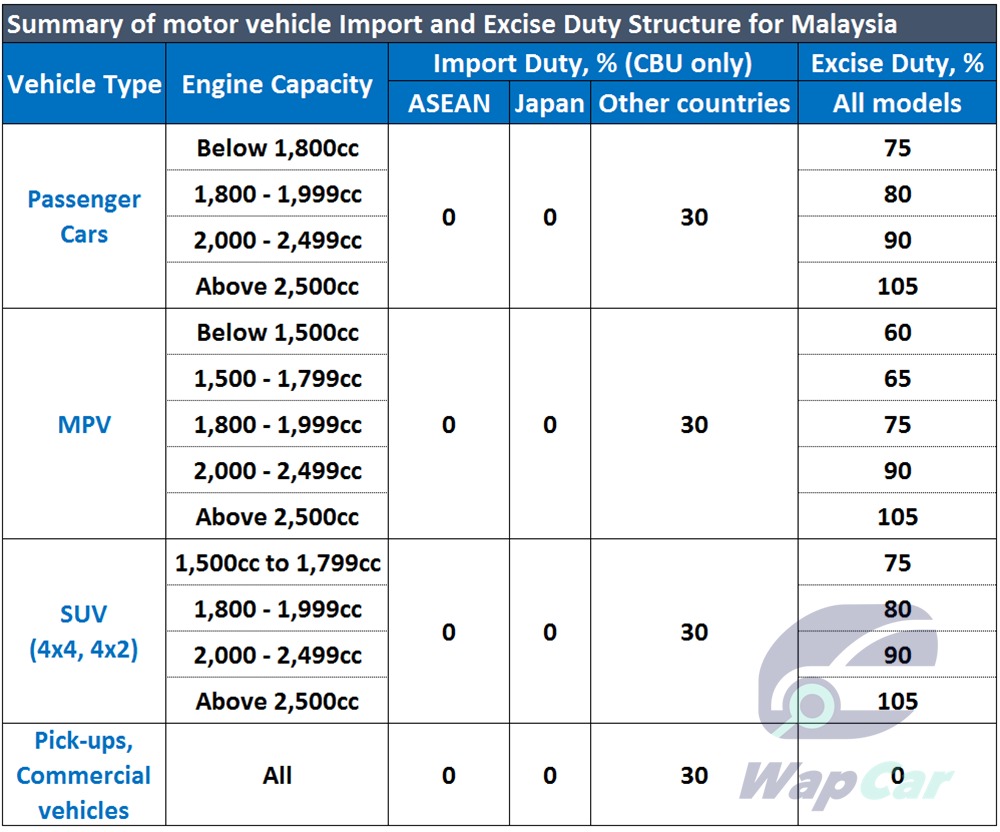

These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. Above 80 kW to 90 kW RM160 and RM032 sen for every 005 kW 50 watt. For electric motorbikes code AA the road tax for such two-wheelers with an output rating of 75 kW and below will be set at a fixed rate of RM2.

Please select 1 - Citizen of Malaysia 2 - Police 3 - Army 4 - CompanyOrganisation 5 - Government 6 - Statutory Body 9 - Non Malaysia Citizen 0 - Permenent Resident of Malaysia. For e-motorcycles with a motor output rated. With an extensive database of new cars on sale in Malaysia.

On top of that RM1 is added on for each cc exceeding 2000 cc. Let us take a closer look at Malaysias unique road tax structure. To calculate the road tax of a vehicle the base rate and progressive rate will have to be combined.

Owner IC Passport No. Owner Vehicle Information. Do note that recently in Malaysias Budget 2022 the government has announced that there will be tax-free incentives for EV cars inclusive of road tax.

LKM Rates Calculation Guidelines for Electric Vehicles. RM274 base rate Remaining 10kW. On April 1 1946 the Road Transport Department was set up to.

So this puts your car into the 100kW 125kW bracket for the road tax. The progressive rate increases as the engine displacement. In Malaysia the latest road tax information and calculations is different in East Malaysia and West Malaysia which the former in general has lower rate than the latter because of the poor geographical condition and road surface.

Above 75 kW the rate is calculated as per the following. So thats RM380 RM494 making. The road tax rate is calculated as follows starting with a base rate and an additional rate for each kW increase.

Saloon cars include sedan hatchback wagon coupe or convertible. Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak is in this link. PLEASE PROVIDE INFORMATION.

RM050 progressive rate x 200 RM100. ROAD TRANSPORT DEPARTMENT MyEG ROAD TAX RENEWAL. Latest JPJ formula - calculate how much your vehicles road tax will cost.

Above 75 kW to 10 kW. Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak revised after the 2009 Budget. Here the tiers base rate is RM380.

In Malaysia car insurance is compulsory and road tax also has to be paid by car owners. Total road tax. MyEG ROAD TAX RENEWAL.

Most cars in Malaysia have less than 20-litre engine displacement. Road Tax for Private Car and Motorcycle. Import duty must be paid on any vehicles imported into Malaysia.

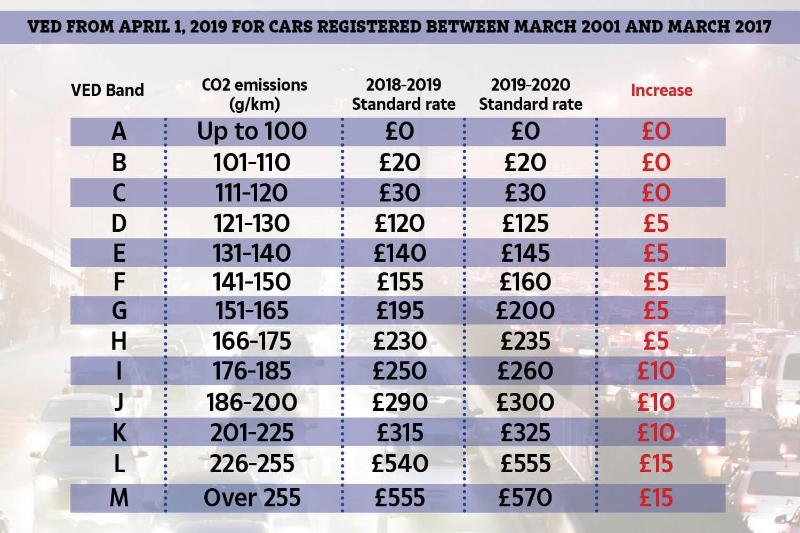

Tax rate for 2020 The tax must be paid in the following amounts NOK per day. Rates calculation guidelines for Electric Vehicles. 790202020202 P1234567.

Vehicle type NOK per day Car w. At minimum the road tax for an engine-driven car is RM20 for cars with engine displacements of 1000 cc and below.

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Topgear Ev Talk Why The New Tesla Model S S Road Tax Would Cost Rm17k In Malaysia

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Road Tax Malaysia Everything You Need To Know Fatberry Blog

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

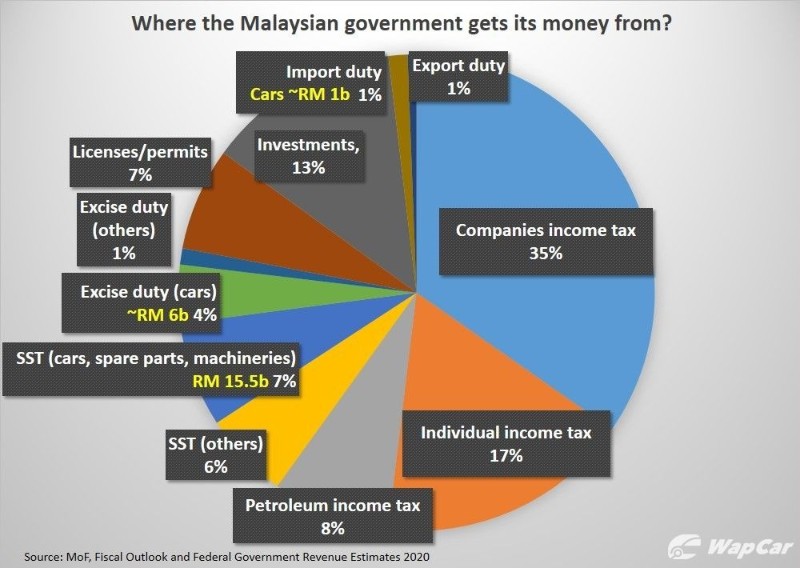

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Car Road Tax Calculator In Malaysia Wapcar

How Much Do You Know About Malaysian Road Tax Ezauto My

How Much Do You Know About Malaysian Road Tax Ezauto My

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Road Tax Paid To Jpj Don T Go To Road Maintenance So What Are We Paying For Wapcar

List Of Tax Deduction For Businesses Cheng Co Group

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org